Sodium Chloride Market to Reach USD 70.9 Billion by 2035, Driven by Chemicals, Water Treatment & Food Processing Growth

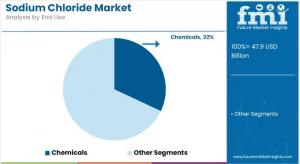

Chemicals will dominate with a 32.0% market share, while solids will lead the product form segment with a 42.0% share.

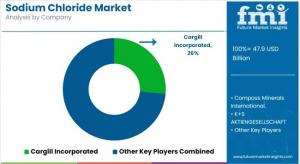

NEWARK, DE, UNITED STATES, November 11, 2025 /EINPresswire.com/ -- The global sodium chloride market is projected to grow from USD 47.9 billion in 2025 to USD 70.9 billion by 2035, expanding at a CAGR of 4.0%. Growth is fueled by rising demand for chlor-alkali chemicals, food processing, and municipal water treatment applications across key regions, including Asia-Pacific, Europe, the United States, and Saudi Arabia.

Sodium chloride, the most abundant industrial mineral, is vital across multiple sectors — from chemical manufacturing and food preservation to deicing and pharmaceuticals. Its versatility and cost-efficiency continue to make it indispensable in modern industry.

Key Figures at a Glance:

* Market Value (2025): USD 47.9 Billion

* Forecast (2035): USD 70.9 Billion

* CAGR (2025–2035): 4.0%

* Top Application: Chemicals (Chlor-Alkali)

* Leading Form: Solid (42%)

* Key Growth Regions: APAC, Europe, USA, Saudi Arabia

Request the complete report to gain a clear understanding of regional growth patterns, innovation trends, and competitive intelligence! Request Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-11612

Global Market Overview

Between 2025 and 2030, the sodium chloride market will expand by USD 10.8 billion, accounting for nearly half of its total growth during the decade. From 2030 to 2035, it is expected to gain an additional USD 12.2 billion, supported by industrial expansion, environmental compliance, and advanced purification technologies.

The chemicals segment remains the cornerstone of demand, commanding 32% of total market share, with chlor-alkali production representing 21% of that segment. Sodium chloride serves as the feedstock for chlorine, caustic soda, and soda ash—critical to producing PVC plastics, detergents, and water treatment agents.

Food & Beverages hold a 19% market share, emphasizing sodium chloride’s essential role in preservation, flavor enhancement, and safety. Water treatment represents 14% of consumption, while deicing applications account for 13%, particularly in colder regions of Europe and North America.

Regional Insights

- Asia-Pacific (APAC): APAC leads global sodium chloride consumption, driven by chemical manufacturing in China, India, and Southeast Asia. Expanding chlor-alkali and food processing industries, coupled with investments in water treatment and pharmaceutical manufacturing, are propelling growth. The region’s demand is projected to rise at a CAGR above 5.1% through 2035, supported by infrastructure modernization and increasing urban water system installations.

- Europe: Europe continues to maintain strong demand for sodium chloride in industrial and environmental applications. Countries such as Germany, the UK, and France rely heavily on road deicing and water treatment applications. The chemicals sector, notably PVC and paper manufacturing, also underpins steady consumption. With stringent environmental standards and an emphasis on sustainable salt mining, European producers are innovating through solar evaporation and vacuum-refined salt technologies.

- United States: The U.S. sodium chloride market is driven by robust chemical production and extensive deicing programs. The country’s established chlor-alkali infrastructure and growing water softening segment ensure consistent demand. Additionally, FDA-approved pharmaceutical-grade salt is gaining momentum for use in IV solutions, oral rehydration, and dialysis, aligning with the healthcare sector’s quality and safety focus.

- Saudi Arabia and the Middle East: The Middle East, particularly Saudi Arabia, is witnessing expansion in sodium chloride applications within petrochemical and desalination sectors. Industrial-grade salt supports chlorine production and oilfield operations, while investments in desalination plants reinforce the need for high-purity grades. Saudi Arabia’s Vision 2030 industrial diversification agenda and regional manufacturing expansion are expected to boost sodium chloride demand by over 20% through 2035.

Market Drivers

- Chlor-Alkali Expansion: Industrialization and construction growth are increasing demand for PVC and caustic soda, both dependent on sodium chloride feedstock. As global PVC production capacity grows, so too does the need for reliable salt supplies.

- Water Treatment and Infrastructure Development: Rising urbanization and water scarcity are prompting governments to expand water treatment and desalination facilities. Sodium chloride plays a key role in regeneration of ion-exchange resins in water softeners and as a disinfectant precursor in municipal treatment.

- Food and Pharmaceutical Applications: Growing packaged food production and healthcare expenditure are boosting demand for food-grade and high-purity sodium chloride. Pharmaceutical formulations, saline solutions, and oral hydration products increasingly rely on refined salt quality.

- Sustainability in Salt Production: Technological advances, including solar evaporation and brine recovery systems, are improving efficiency and reducing environmental impact. These developments are essential for aligning with environmental regulations across Europe and APAC.

Gain complete access to the report for extensive coverage of market forecasts, competitive benchmarking, and evolving industry trends! Buy Full Report: https://www.futuremarketinsights.com/checkout/11612

Challenges

Despite its essential role, sodium chloride faces challenges from environmental restrictions on deicing applications and competition from substitutes like potassium chloride in water treatment. Salt runoff into freshwater ecosystems remains a concern, prompting innovation toward eco-friendly formulations and controlled application systems.

Segmental Breakdown

- By End Use: Chemicals (32%), Food & Beverages (19%), Water Treatment (14%), Deicing (13%), Industrial (9%), Oil & Gas (5%), Pharmaceuticals (4%), Agriculture (4%)

- By Product Form: Solid (42%), Brine (33%), Vacuum-Refined/High-Purity Salt (25%)

- By Source: Sea Water & Brine, Solid Mining

Growth Outlook 2025–2035

From 2025 to 2035, the global sodium chloride market will grow by nearly 1.5 times, with an absolute increase of USD 23 billion. Solid form will continue to dominate due to broad applicability and cost-effectiveness. However, refined vacuum salt and brine systems will see accelerated growth in industries requiring higher purity, including pharmaceuticals, electronics, and food processing.

Regional Market Contribution (2035 Forecast):

- APAC: 41% share

- Europe: 27% share

- USA: 22% share

- Saudi Arabia and Middle East: 10% share

Key Strategic Opportunities

- Producers: Invest in solar evaporation and brine recovery systems to enhance eco-efficiency and cost competitiveness.

- Investors: Focus on expanding capacity in APAC and the Middle East, where infrastructure and industrial growth are fastest.

- Technology Providers: Develop process control systems for salt refining, ensuring consistent purity across end-use segments.

Exploring Insights Across Emerging Global Markets:

Fatty Esters Market: https://www.futuremarketinsights.com/reports/fatty-esters-market

Ethylene Amines Market: https://www.futuremarketinsights.com/reports/ethylene-amines-market

Ethylene Carbonate Market: https://www.futuremarketinsights.com/reports/ethylene-carbonate-market

Paraffins Market: https://www.futuremarketinsights.com/reports/paraffins-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.